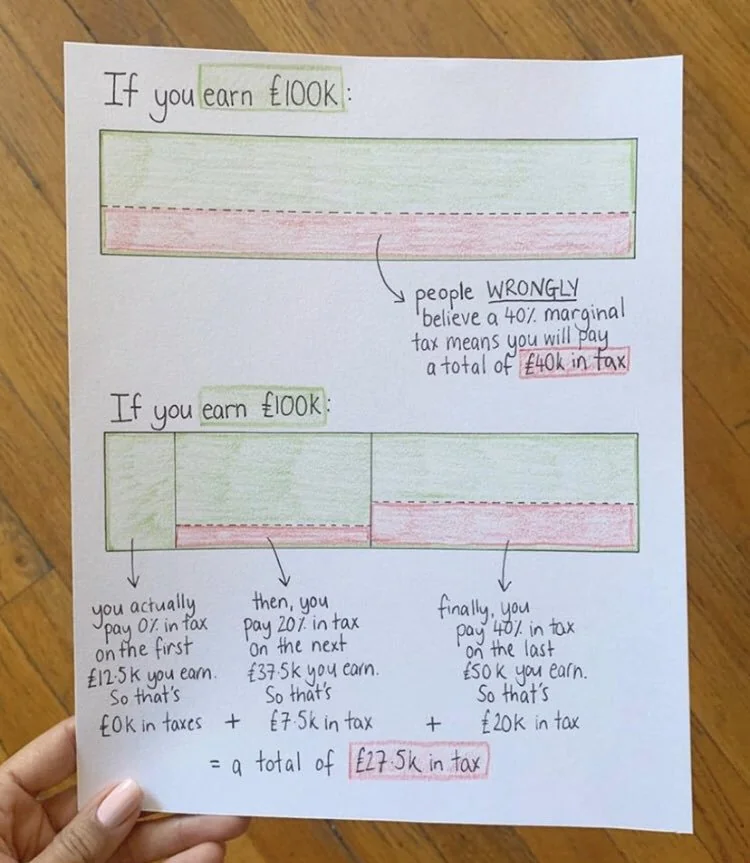

Under a marginal tax rate, taxpayers are most often divided into tax brackets or ranges, which determine the rate applied to the taxable income of the tax filer. As income increases, the last dollar earned will be taxed at a higher rate than the first dollar earned. In other words, the first dollar earned will be taxed at the rate for the lowest tax bracket, the last dollar earned will be taxed at the rate of the highest bracket for that total income, and all the money in between is taxed at the rate for the range into which it falls.

Comments